inheritance tax rate kansas

Over 10000 to 20000. Over 1000 to 10000.

New Stimulus Package May Be Introduced Next Week Estate Tax Types Of Trusts Senate

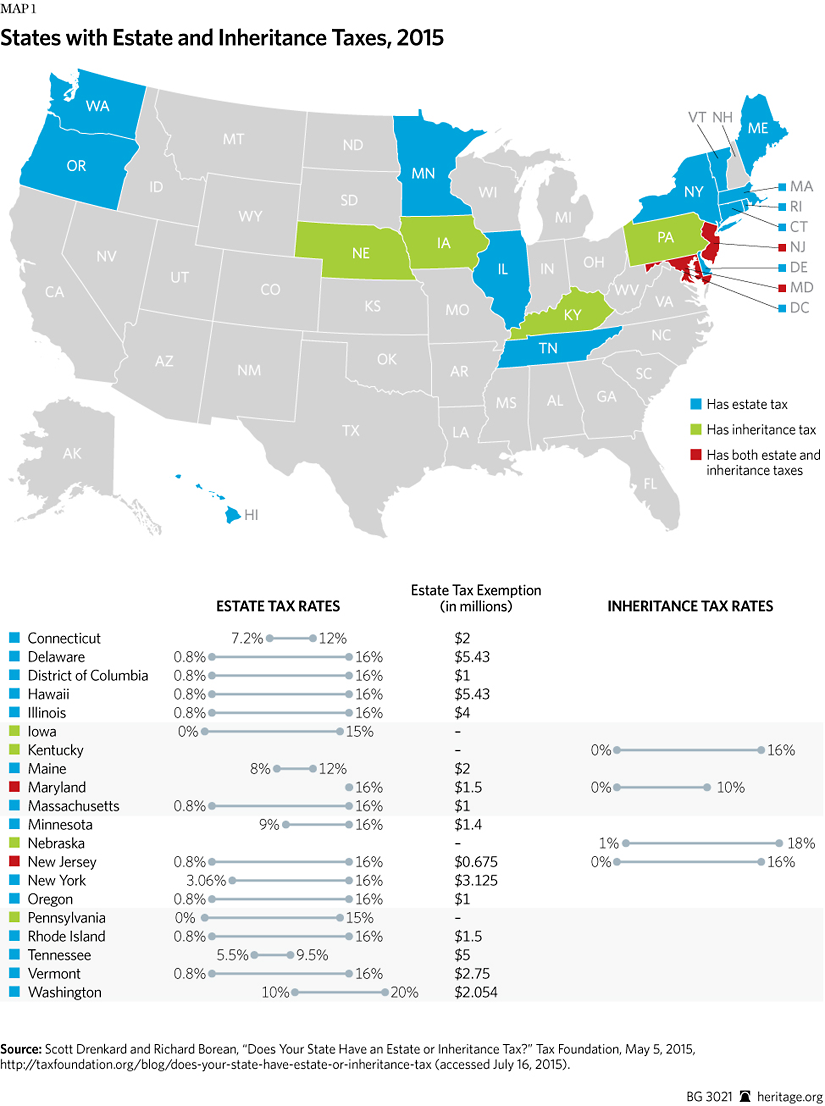

Class C beneficiaries receive a 500 exemption and the tax rate is 6 percent to 16 percent.

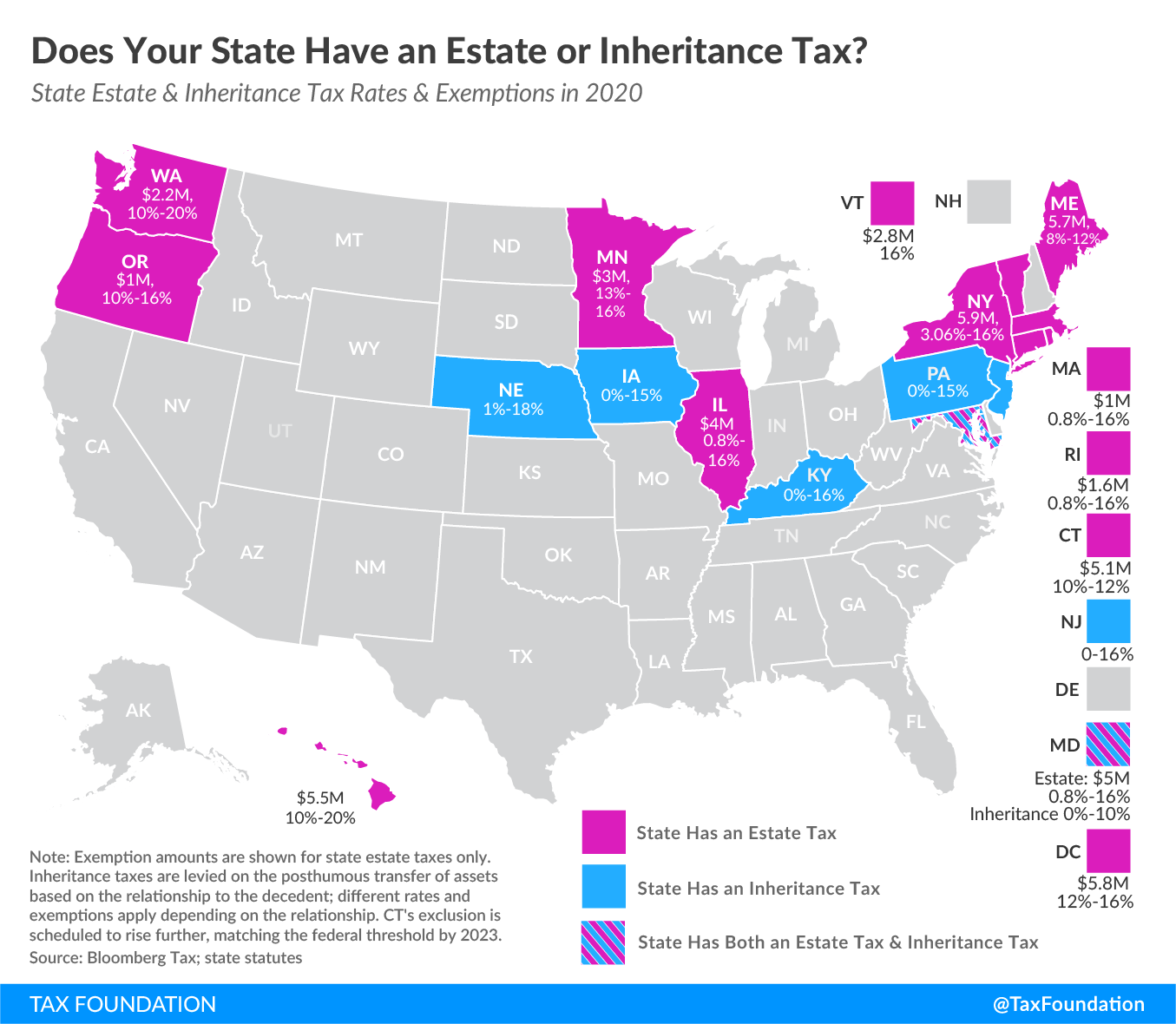

. Connecticuts estate tax will have a flat rate of 12 percent by 2023. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware.

On the other hand let us consider New Jersey for our Garden State subscribers. Twelve states and Washington DC. The state has a progressive income tax with rates ranging from 310 to 570.

Kansas taxes Social Security income only for those with an Adjusted Gross Income over 75000. 6 rows Kentucky inheritance taxes should be filed within 18 months of the decedents death. In Kansas the median property tax rate is 1369 per 100000 of assessed home value.

Fortunately neither Kansas nor Missouri has an inheritance tax. Kentucky Class B inheritance tax rate. The state sales tax rate is 65.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Even though Kansas does not collect an inheritance tax however you could end up paying inheritance tax to another state.

With city and county taxes the average sales tax rate is 862 and can climb over 9. County taxes is 075 and city and township taxes are 225. Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

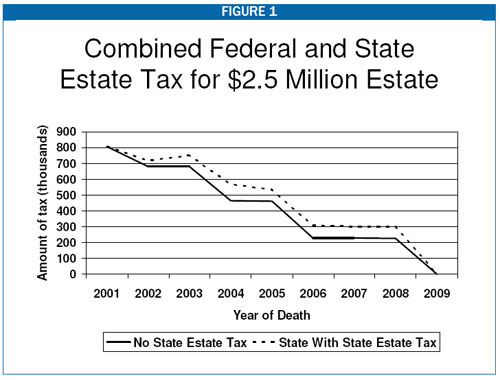

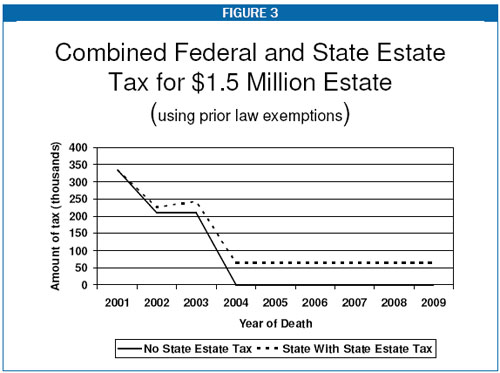

The maximum Maryland estate tax rate of 16 is not altered with the new legislation. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The amount of federal estate tax that will be levied on an estate depends upon the size of the taxable estate and there is a maximum federal estate tax rate of forty percent.

Kentucky Class C inheritance tax rate. The top inheritance tax rate is 16 percent exemption threshold for Class C. All Major Categories Covered.

In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget. The state has a relatively high property taxes. The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax exemption.

There is no federal inheritance tax but there is a federal estate tax. The surtaxes are generally uniform. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

These surtaxes cumulatively raised approximately 24 million in 2008. See the tax chart on page 6 of the Guide to Kentucky Inheritance and Estate Taxes. Over 500 to 1000.

Impose estate taxes and six impose inheritance taxes. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the baseline rates until 2025 when the tax will be fully eliminated. As mentioned previously the probate process in Kansas typically takes anywhere from eight months to three years to finalize.

What if you die in 2018. Like most states Kansas has a progressive income tax with tax rates ranging from 310 to 570. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

The District of Columbia moved in the. Does kansas have inheritance tax. The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1.

The top rate in 2020 was 15 percent but a reduction of 40 percent brings the top rate to 9. Ad The Leading Online Publisher of National and State-specific Wills Legal Documents. The sales tax rate in Kansas for tax year 2015 was 615 percent.

The statewide sales tax rate in Kansas is 650. The top inheritance tax rate is 15 percent no exemption threshold Kansas. Twelve states and Washington DC.

The surviving spouse and children are exempt from an inheritance tax. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process. Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9.

No city or township has a rate higher than 225 and 36 have a lower rate as low as 025. If you inherit from somone who lived in one of the few states that has an inheritance tax--Iowa Kentucky Nebraska New Jersey Pennsylvannia and Maryland --you may get a tax bill from that state.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Does Kansas Charge An Inheritance Tax

Estate Tax Rates Forms For 2022 State By State Table

Estate Tax Rates Forms For 2022 State By State Table

Assessing The Impact Of State Estate Taxes Revised 12 19 06

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is Inheritance Tax Probate Advance

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State Death Tax Is A Killer The Heritage Foundation

Kentucky Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Feb11 Gardner Table 1 Investing Financial Financial Planning

Estate Tax Rates Forms For 2022 State By State Table

Estate And Inheritance Tax State By State Housing Gurus

States With No Estate Tax Or Inheritance Tax Plan Where You Die